If you want to find property details in Morrow County using only the owner’s name, this step by step guide explains the complete process of performing a Property Search by Owner Name from entering the name to correctly reading the results.

This search method is one of the fastest ways to verify property ownership, locate parcel numbers, and review assessed values and tax status. Whether you’re a homeowner, buyer, realtor, investor, or legal professional, using the official https://auditor.co.morrow.oh.us/ website ensures access to accurate and up to date county records.

Morrow County Property Search by Owner Name

How to Do a Property Search by Owner Name (Full Process)

Performing a property search by owner name in Morrow County is simple, but accuracy matters. Follow these steps carefully to get correct results.

Step by Step Instructions

| Step | Action | Details |

|---|---|---|

| 1 | Visit the Official Website | Go to https://auditor.co.morrow.oh.us/ using a mobile or desktop device |

| 2 | Open Property Search | Click Property Search from the main menu |

| 3 | Choose Owner Name Search | Select Search by Owner Name from the options |

| 4 | Enter Owner’s Full Name | Type the legal name (example: John A. Smith) |

| 5 | Click Search | Press the search button to begin lookup |

| 6 | Review Results | View all properties linked to that owner |

This process retrieves all parcels registered under the entered owner name within Morrow County.

What You’ll See in the Search Results

After completing a property search by owner name, the system displays a list of properties associated with that individual or entity.

Information Typically Shown:

- Owner’s legal name

- Property address

- Parcel number (Parcel ID)

- Assessed value

- Tax status

- Transfer or sale history

Example View:

| Owner Name | Property Address | Parcel ID | Assessed Value | Tax Status |

|---|---|---|---|---|

| John A. Smith | 210 W High St, Mount Gilead OH | 07-015-A-00012 | $162,300 | Paid |

| John A. Smith | 845 County Rd 25, Cardington OH | 12-009-B-00345 | $198,700 | Due |

Each row represents a separate property. Clicking a parcel opens full property details.

How to Read and Understand Your Results

Understanding the results of a property search by owner name helps ensure accuracy and prevents misinterpretation of county records.

Owner Name

This shows the official legal owner as recorded by the Morrow County Auditor.

It confirms who holds legal ownership rights for the property.

Parcel ID

A unique number assigned to each property for identification in county records.

It is used for tracking taxes, ownership history, and legal references.

Property Address

The physical location of the property listed in county files.

It helps verify the exact property tied to the owner and parcel.

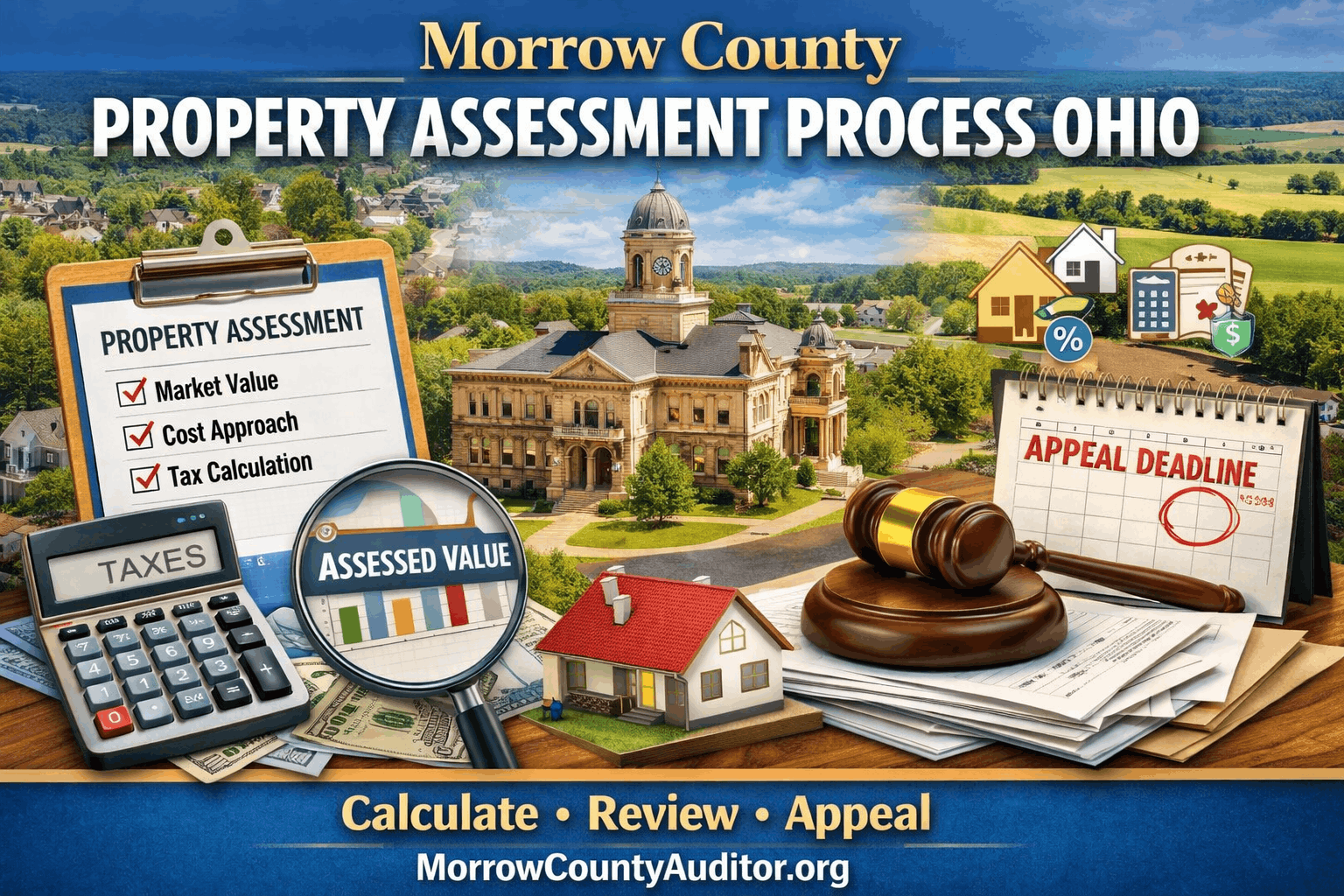

Assessed Value

The value assigned by the county auditor for property tax purposes.

This amount may differ from market value and is used to calculate taxes.

Tax Status

Indicates whether property taxes are paid, due, or delinquent.

It helps identify any outstanding tax obligations linked to the property.

Transfer Date

The most recent date the property was sold or ownership changed.

It reflects the latest recorded transaction in county records.

These details together provide a clear and complete view of property ownership and valuation.

Tips for Getting Accurate Results

Small mistakes can affect your property search by owner name results. Follow these best practices:

- Use exact legal spelling of the owner’s name

- Try name variations if unsure (e.g., William / Bill)

- Avoid adding middle initials unless officially recorded

- Narrow results using township or location filters if available

- Always confirm parcel numbers before saving records

These steps ensure clean, accurate, and verified results.

Why Use Property Search by Owner Name in Morrow County

- Instantly confirms who legally owns a property in Morrow County.

- Displays official, county verified ownership and parcel records.

- Shows parcel ID, assessed value, and tax status in one place.

- Ideal when the property address or parcel number is unknown.

- Accessible online 24/7 through the official county website.

A property search by owner name offers a complete ownership overview using minimal information.

Advanced Uses of Property Search by Owner Name

- Homeowners: Ensure property records are correctly listed under their name.

- Buyers: Verify legal ownership before finalizing a purchase.

- Realtors: Review all properties owned by a client or investor.

- Attorneys: Confirm ownership for estate, title, or legal matters.

- Lenders: Validate ownership before approving loans or mortgages.

- Researchers: Study ownership trends and property distribution.

All results are sourced directly from official Morrow County property records.

Conclusion

A Property Search by Owner Name in Morrow County is one of the most reliable ways to access accurate property ownership information without needing an address or parcel number. Using the official county auditor’s records, this search method provides verified details such as owner name, parcel ID, assessed value, tax status, and transfer history. It is especially useful for homeowners, buyers, real estate professionals, and legal experts who need quick and trustworthy data. By understanding how to read the results correctly, users can make informed property decisions with confidence and avoid errors when verifying ownership or property records.

Frequently Asked Questions (FAQs)

What is a property search by owner name in Morrow County?

A property search by owner name allows users to find all properties registered under a specific individual or entity using official Morrow County Auditor records, without needing a parcel number or property address.

Is the Morrow County property search by owner name free to use?

Yes, the property search by owner name is completely free and accessible through the official Morrow County Auditor website, providing public access to verified ownership, tax, and property assessment information.

Can I find multiple properties owned by the same person?

Yes, this search method displays all parcels associated with the entered owner name, making it easy to review multiple properties owned by the same individual, business, trust, or legal entity.

How accurate is the property search by owner name?

The results are highly accurate because the data comes directly from official Morrow County property records, which are regularly updated to reflect ownership changes, assessments, and tax status.

What should I do if I see incorrect ownership information?

If ownership details appear incorrect, verify the parcel ID and transaction history, then contact the Morrow County Auditor’s Office to request clarification or correction using official documentation.

Can I use this search for legal or real estate purposes?

Yes, the property search by owner name is widely used by buyers, realtors, attorneys, and lenders to verify ownership, assess property details, and support legal or real estate decisions.